coweta county property tax rate

You should check with your county tax office for verification. There are approximately 11363 people living in the Coweta area.

Coweta School Board Approves 2021 22 Budget Winters Media

At that rate a homeowner whose home has a market value of 100000 would pay just 720 annually in property taxes.

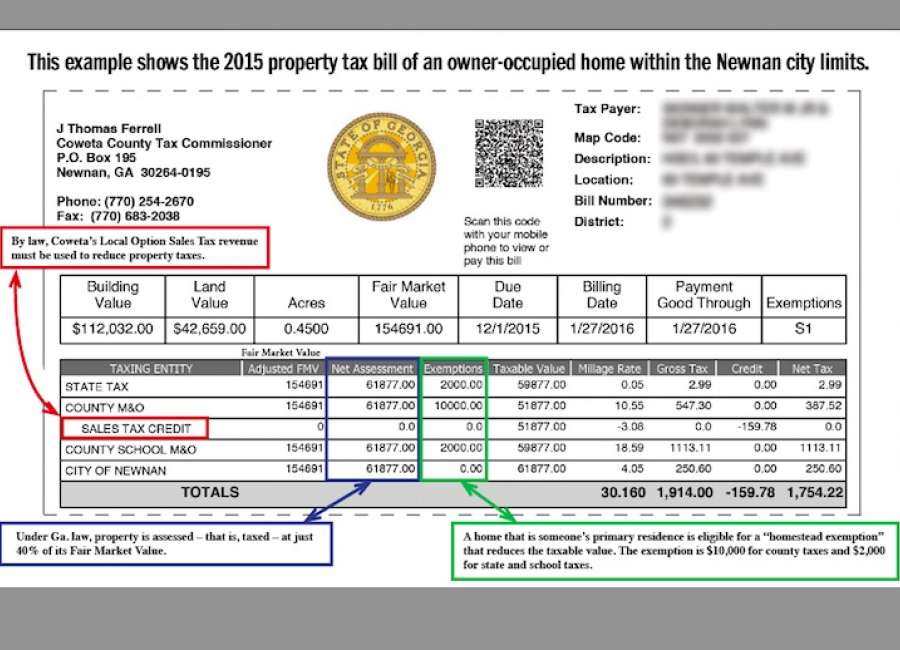

. Coweta County GA. Everyone visiting the County Administration Building is required to enter through the East Broad St entrance. Coweta County collects on average 081 of a propertys assessed fair market value as property tax.

There were no speakers at the hearing. The effective property tax rate is just 072 well below the state average of 087. Property tax rates in Cobb County rank among the lowest in the state.

This sheet supplies several years of levy rates to show how much your taxes can fluctuate because of a levy increasedecrease and not necessarily a raise in your property value. This is the total of state and county sales tax rates. 770 254 2680 Phone 770 254 2649Fax The Coweta County Tax Assessors Office is located in Newnan Georgia.

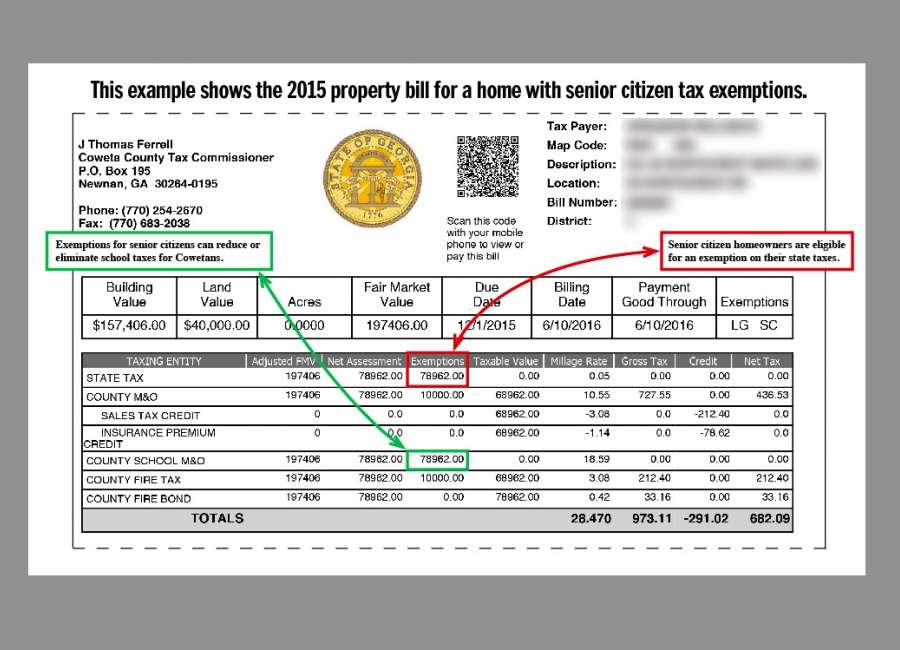

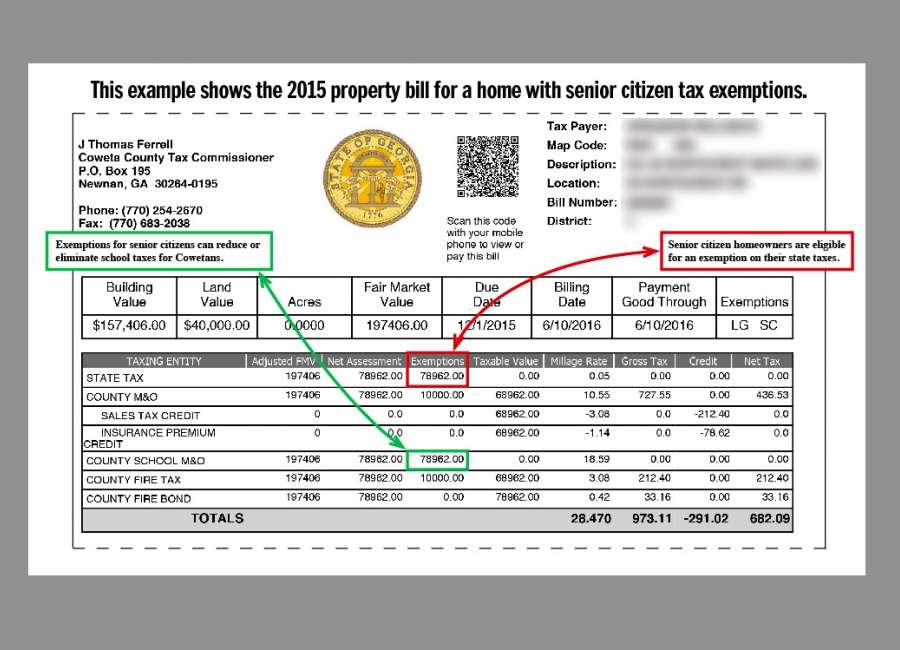

Property Tax in Coweta County GA 2022 Guide Rates Due Date Exemptions Calculator Records Codes. Property Tax Info Coweta County GA Website. Coweta County collects relatively high property taxes and is ranked in the top half of all counties in the United.

The Coweta County sales tax rate is. Please use the link below to plan your visit. CLICK HERE to join the queue or set up an appointment.

Whether you are already a resident or just considering moving to Coweta County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Georgia state sales tax rate is currently. The Coweta County Sales Tax is collected by the merchant on all qualifying sales made within Coweta County.

Coweta County GA currently has 455 tax liens available as of March 26. The minimum combined 2022 sales tax rate for Coweta County Georgia is. A county-wide sales tax rate of 3 is applicable to localities in Coweta County in addition to the 4 Georgia sales tax.

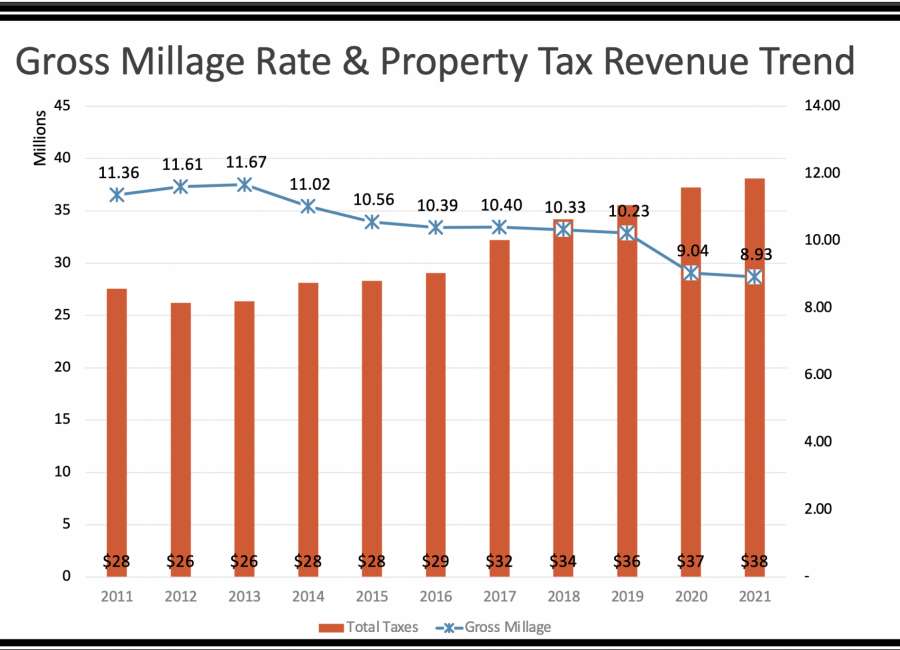

Whether you are already a resident or just considering moving to Coweta to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Coweta County wont be increasing the millage rate this year but property owners who saw their values increase will be paying a bit more in county taxes under the proposed rate. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate of 081 of property value.

Coweta County Property Tax. Has impacted many state nexus laws and sales tax. In some counties property tax returns are filed with the county tax commissioner and in other counties returns are filed with the county board of tax assessors.

The median property tax on a 17790000 house is 186795 in the United States. Limited space is available in the lobby area. The rate was set after a public hearing.

The Coweta County Sales Tax is 3. Collected from the entire web and summarized to include only the most important parts of it. Use the rate from this LEVY SHEET for the most current year.

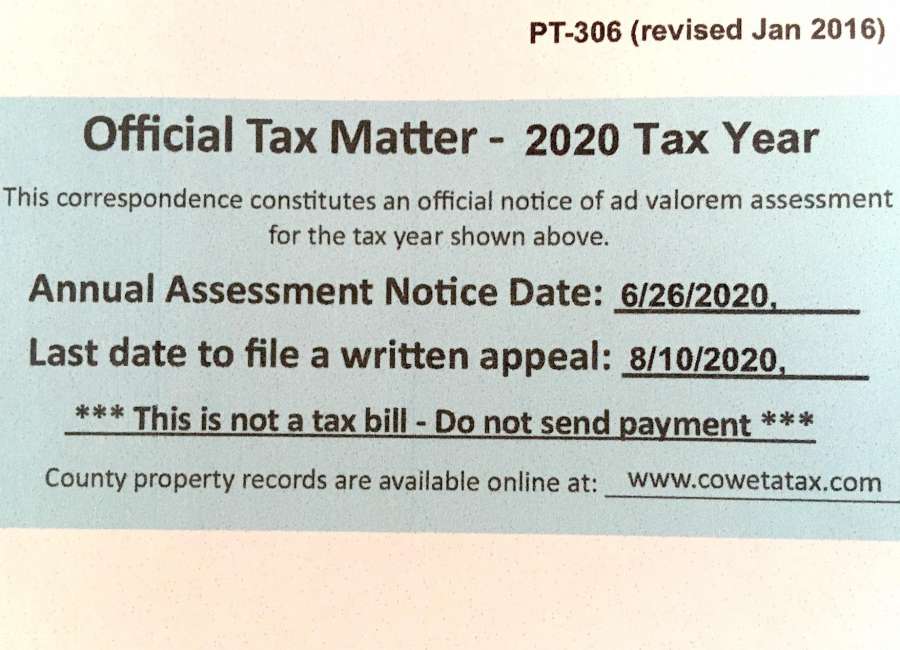

The median property tax on a 17790000 house is 144099 in Coweta County. Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. The 2018 United States Supreme Court decision in South Dakota v.

Some cities and local governments in Coweta County collect additional local sales taxes which can be as high as 1. Remember that zip code boundaries dont always match up with political boundaries like Coweta or Wagoner County so you shouldnt always rely on something as imprecise as zip codes to determine the sales tax rates at a given. Levies are certified each year between October and November just before the tax roll is created.

The county is proposing the same property tax millage rate as last year for county operations the Coweta County Fire District and the county fire bond district. The large change was the result of a county-wide revaluation which significantly increased the countys tax digest. The 2020 millage rate was down from 66 mills in 2019.

The Coweta County Tax Assessor is the local official who is responsible for assessing the taxable. The Coweta County Georgia sales tax is 700 consisting of 400 Georgia state sales tax and 300 Coweta County local sales taxesThe local sales tax consists of a 300 county sales tax. Coweta County collects a 3 local sales tax the maximum local sales tax.

The Coweta Oklahoma sales tax rate of 88 applies in the zip code 74429. Use the Search and Pay Taxes link above to verify property tax payment received. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

The median property tax on a 17790000 house is 147657 in Georgia. Learn all about Coweta real estate tax. Can be used as content for research and analysis.

Get driving directions to this office. 2016 Millage Rates for Coweta County Georgia NOTICE OF PROPERTY TAX INCREASE The Coweta County Board of Commissioners has tentatively. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Coweta County GA at tax lien auctions or online distressed asset sales.

Coweta County Assessors Office Services. Last years millage rate for the unincorporated areas was 5772 which was itself the rollback rate. What is the property tax rate in Georgia County Coweta.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. Learn all about Coweta County real estate tax.

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

County Sets Millage Rates The Newnan Times Herald

Esplost 2021 Newnan Coweta Chamber Ga

Georgia Sales Tax Guide For Businesses

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Esplost 2021 Newnan Coweta Chamber Ga

One For Coweta Sales Tax Increase Passes News Tulsaworld Com

Coweta County School Board Approves 2020 21 Budget Winters Media

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Esplost 2021 Newnan Coweta Chamber Ga

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More