unlevered free cash flow yield

Its principal application is in valuation where a discounted cash flow model. Levered free cash flow LFCF is the money left over after all a companys bills are paid.

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

To break it down free cash flow yield is determined first by using a companys cash flow statement.

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

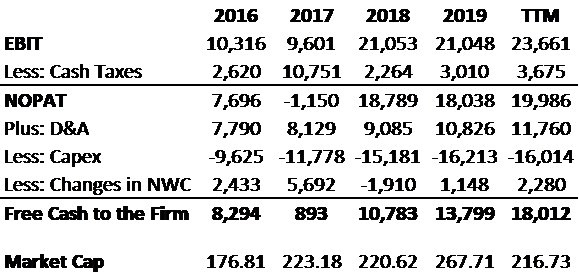

. Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value. Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator. Free Cash Flow to Firm FCFF NOPAT DA Change in NWC CapEx.

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided. Free cash flow yield is a financial ratio which measures that how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per share with market price per share and indicates the level of cash flow company is going to earn against its market value of the share. The Formula for Free Cash Flow Yield is.

View SP Global Incs Unlevered Free Cash Flow Yield trends charts and more. Unlevered free cash flow can be reported in a companys. Unlevered Free Cash Flow 62336 B Total Enterprise Value 25244 B FCF Yield 25.

Unlevered free cash flow for the second quarter of 2021 was 443 million yielding a margin of 207 compared to unlevered free cash flow of 154 million and a margin of 84 in the. Free cash flow yield is really just the companys free cash flow divided by its market value. 1 0 Y A F C F O S O W P S P L C A I where.

LFCF yield is calculated as levered free cash flow divided by the value of equity. CapEx and increases in NWC each represent outflows of cash which means less free cash flow remains post-operations for payments related to servicing interest debt amortization etc. F r e e C a s h F l o w Y i e l d F r e e C a s h F l o w p e r S h a r e M a r k e t P r i c e p e r S h a r e.

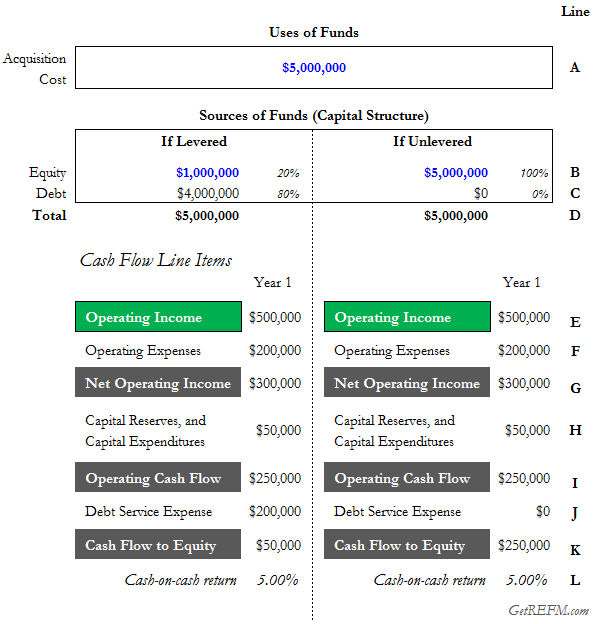

LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. FCF Yield Unlevered Free Cash Flow Total Enterprise Value Applying this formula Inari Amertron Berhads FCF Yield is calculated below. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560. A complex provision defined in section 954c6 of the US. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made.

FCF Yield Unlevered Free Cash Flow Total Enterprise Value Applying this formula AutoNations FCF Yield is calculated below. Therefore levered free cash flow includes the impact of financial leverage. Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable.

FCF Yield Unlevered Free Cash Flow Total Enterprise Value Applying this formula Microsofts FCF Yield is calculated below. Cash flow yieldfrac cash flow per share price per share cashf low yield price per sharecash f low per share. C a s h f l o w y i e l d c a s h f l o w p e r s h a r e p r i c e p e r s h a r e.

Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value. Unlevered Free Cash Flow 2195 B Total Enterprise Value 11364 B FCF Yield 193. Free Cash Flow Yieldfrac Free.

A company with debt will have a higher unlevered FCF yield than a levered FCF yield. The look thru rule gave qualifying US. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. Internal Revenue Code that lowered taxes for many US. A company can have a negative levered free cash flow even if operating cash flow is positive.

Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to. The cash flow yield formula is. Putting this all together the formula has been shown below.

SP Globals latest twelve months unlevered free cash flow yield is 38. Cash Flow Yield Formula. 1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O.

Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. FCF yield is also known as Free Cash Flow per Share. Unlevered Free Cash Flow - UFCF.

Unlevered Free Cash Flow RM4181 M Total Enterprise Value RM10357 B FCF Yield 40. Levered free cash flow vs. Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Fcf Yield Unlevered Vs Levered Formula And Calculator

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Ufcf Lumovest

Fcf Yield Unlevered Vs Levered Formula And Calculator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Free Cash Flow Yield Explained

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Free Cash Flow Definition Examples Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial